Contents

Summaries from each of the speakers are available on this page. Click on the link below to go to your chosen speaker's summary.

Dr John Hewson

Dr John Hewson, former politician and businessman will be the Keynote speaker. He will address the implications of this issue on the Australian investment industry.

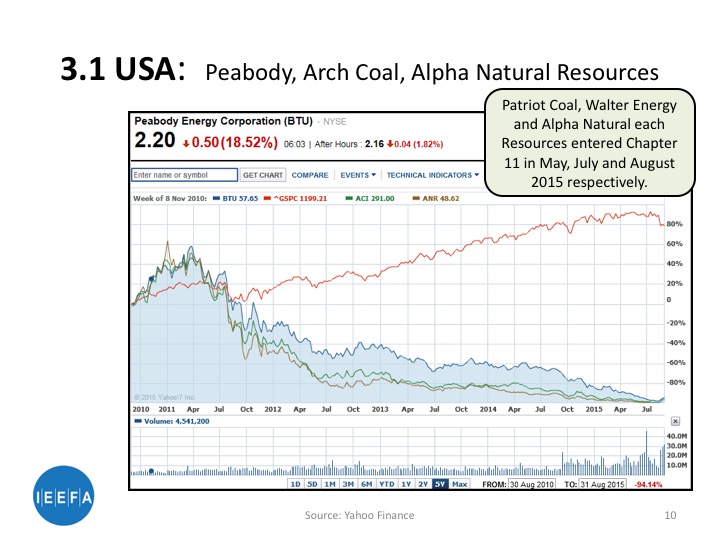

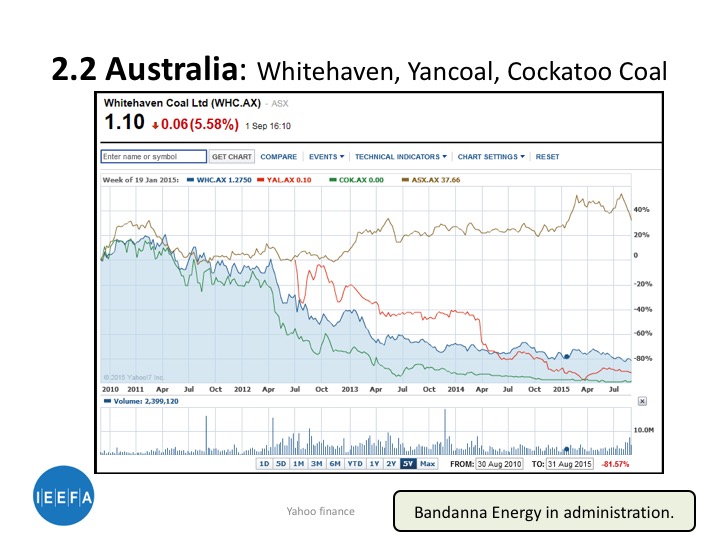

"Dr John Hewson said that investors should carefully assess the risks of investing in carbon exposed/climate exposed industries. He noted that coal shares globally have already suffered very large value loss. He believes the risk of a climate induced global financial crisis actually dwarfs the risk that was run with the recent sub-prime crisis that produced the GFC.”

Dr Hewson is an economic and financial expert with experience in academia, business, government, media and the financial system. He has worked as an economist for the Australian Treasury, the Reserve Bank, the International Monetary Fund and as an advisor to two successive Federal Treasurers and the Prime Minister.

He is currently a Professor and holds a Chair in the Tax and Transfer Policy Institute at Crawford School, ANU.

Dr Hewson has been active in the climate debate since the early '90s, including roles as Chair Asset Owners' Disclosure Project, Chair National Business Leader's Forum on Sustainable Development and by building many companies in renewables, energy efficiency and alternative technologies.

His business career before entering politics in 1987 was as a company director and business consultant and included roles as Foundation Executive Director, Macquarie Bank Limited and as a Trustee of the IBM Superannuation Fund.

John's political career included seven years as a ministerial advisor and a further eight years as the Federal Member for Wentworth in the Federal Parliament. He was Shadow Finance Minister, Shadow Treasurer and Shadow Minister for Industry and Commerce, then Leader of the Liberal Party and Federal Coalition in Opposition for four years.

Sarah Barker

Sarah Barker, Special Counsel at Minter Ellison.

"Directors can no longer ignore the risks presented by climate change. Denial is not an option. They must proactively investigate the risks and develop strategies to safeguard their corporation's continuing prosperity."

Sarah's talk will address the potential liability for company directors and is based around the following notes:

Misleading or deceptive conduct

Outline of potential liability exposure of directors where:

- Commitments to action on climate change is 'overstated'

- Offer documents do not account for stranded asset risks (eg recent US prosecutions)

- Asset valuations overstated (current ASIC focus)

Directors' duties

The two core fiduciary duties of company directors are that they act (1) in the best interests of the company (ie trust/loyalty) and (2) they exercise due care and diligence in the discharge of their functions (ie competence). Applying developments in science, economics and law to both sides of this 'fiduciary equation' suggests that active consideration of stranded asset risks (and risks/opportunities associated with climate change risks more broadly) is now not only permitted but increasingly required in order to satisfy company directors' duties:

- In relation to the 'best interests' of the company, there continues to be an active debate on whether such interests can be more broad than the maximisation of financial wealth (ie shareholder primacy vs stakeholder theories of corporate social responsibility). That debate is irrelevant here. That is because the developments in the science and economics on climate change outlined by the first three panellists mean that it is no longer a 'non-financial environmental externality' but a material financial risk. It is therefore an issue that squarely impacts on the best (financial) interests of the company – across all schools of CSR.

- In relation to due care and diligence', regulators and courts holding company directors to higher standards of professionalism, engagement and proactivity in order to satisfy their duty of due care and diligence (as against the standard of a 'reasonable director' in the relevant circumstances).

Applying these developments to the two halves of the fiduciary equation, a failure to proactively interrogate stranded asset risks is increasingly likely to breach the directors' duty of due care and diligence, by reference to the five most common rationales for inaction. These rationales include (a) denial, (b) honest ignorance, (c) uncertainty/complexity leading to strategic paralysis, (d) 'the lemmings' (ie default to benchmarks of industry norms or regulatory requirements) and even (e) cost/benefit analysis that concludes 'business as usual' is profit maximising - where the modelling assumptions and methodologies applied are historically, but not prospectively, fit for purpose.

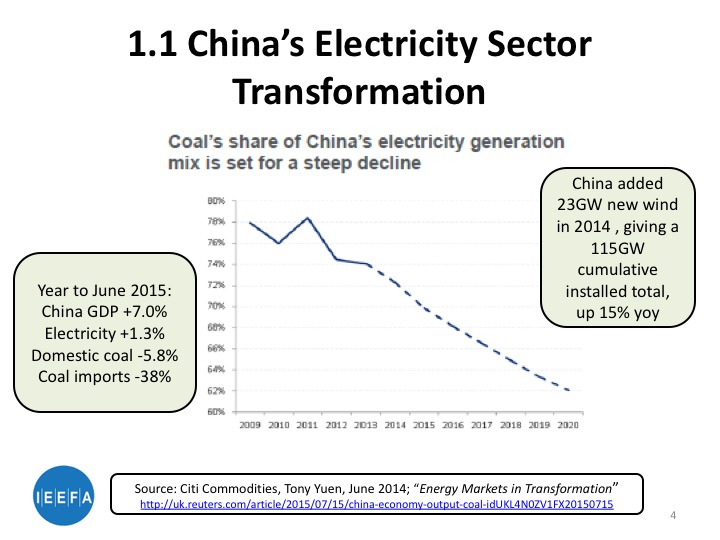

Tim Buckley

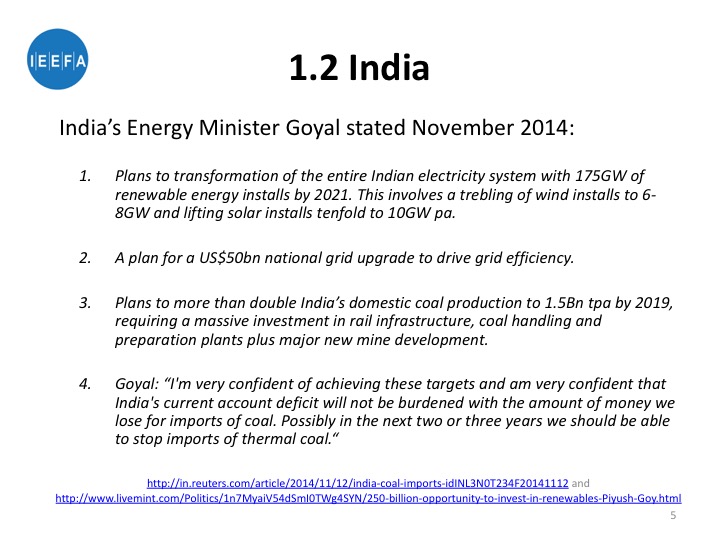

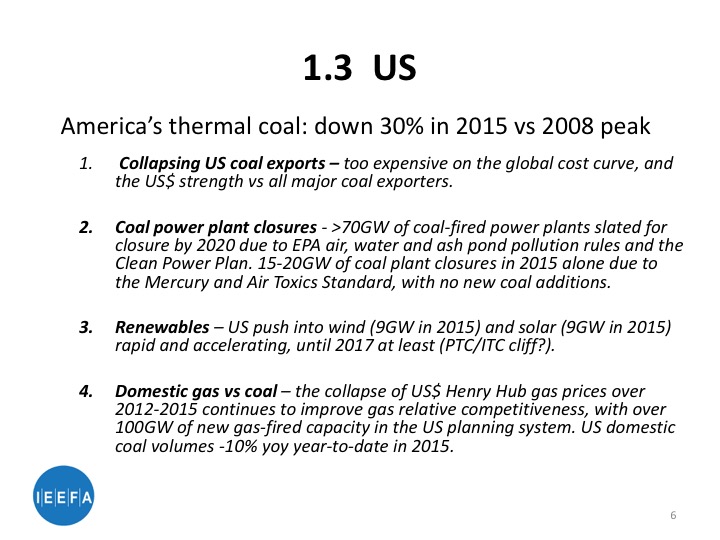

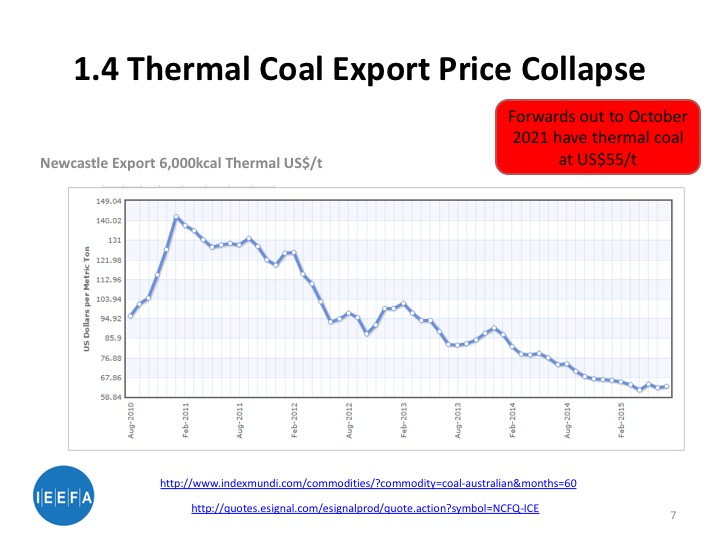

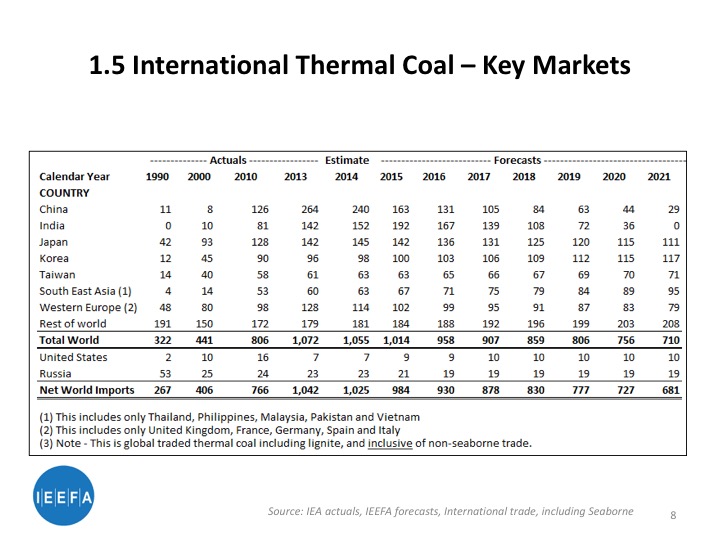

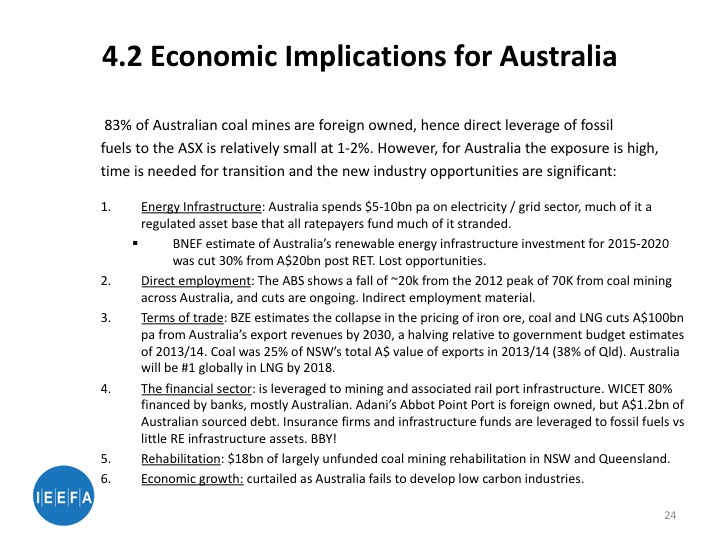

Tim Buckley is an experienced industry analyst and he will speak about the outlook for the first potential victim of this issue - Australian coal exports.

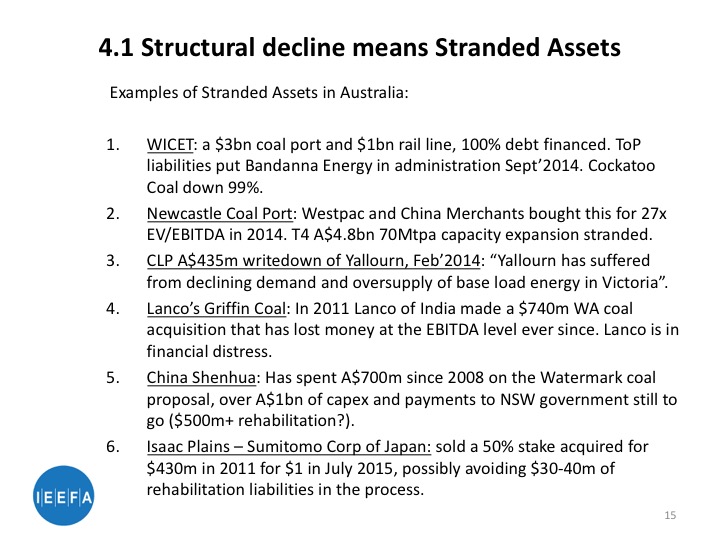

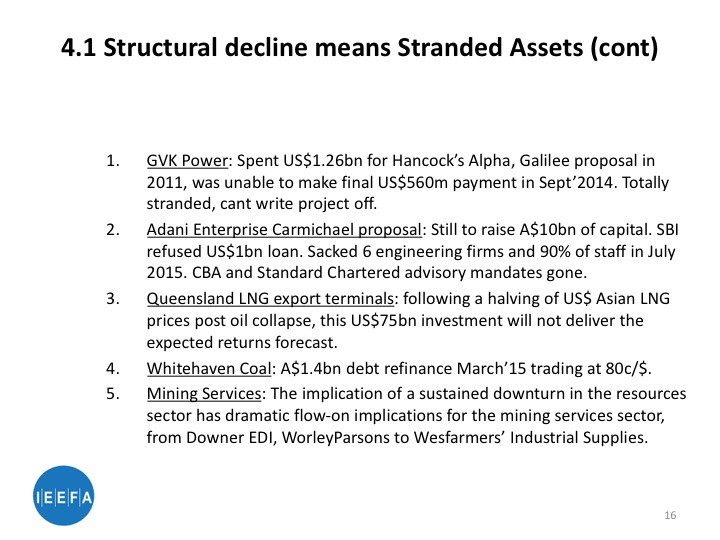

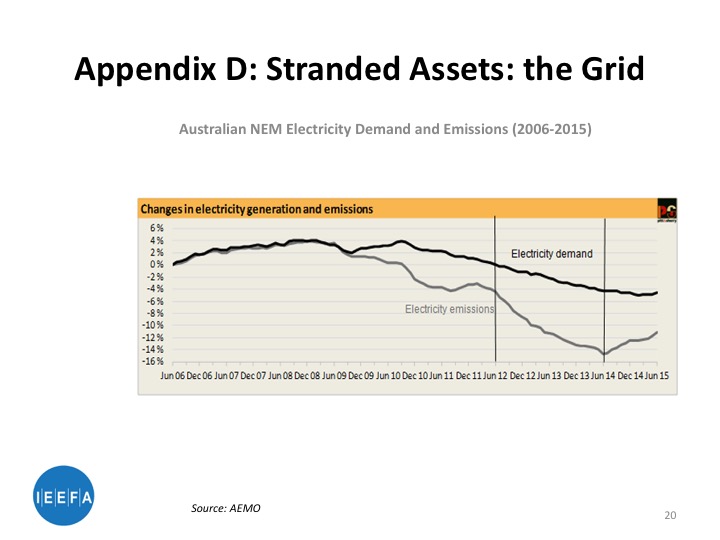

"Tim Buckley considers that the outlook of Australia's thermal coal export market is very bleak and there is a very high likelihood that the Queensland Galilee coal mine and its supporting infrastructure will become stranded assets."

Alex Frankel

Alex Frankel, experienced communications strategist.

Alex is Director at Frankly, a Melbourne based research and communications firm. He is one of Australia’s foremost communications strategists. He has extensive experience working with, NGOs, corporations and political parties.

Prior to founding Frankly, Alex was a General Manager at the Labor polling firm that conducted the communications research culminating in the naming of Australia’s “Clean Energy” legislation.

In recent years, he has conducted polling, focus groups and directed narrative strategy for the Australian Greens. He has a keen interest in the role of business and the opportunities presented by the shift to clean energy.

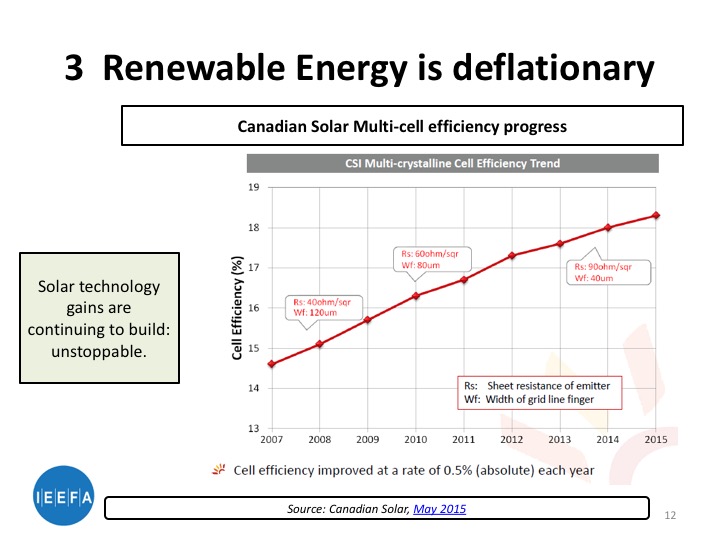

Alex will address the coming transition to clean energy.